Social Security Employee Rate 2024

Social Security Employee Rate 2024. Social security payouts jump as 3.2% cola kicks in for 2024. You file a federal tax return as an individual and your combined income is more than $34,000.

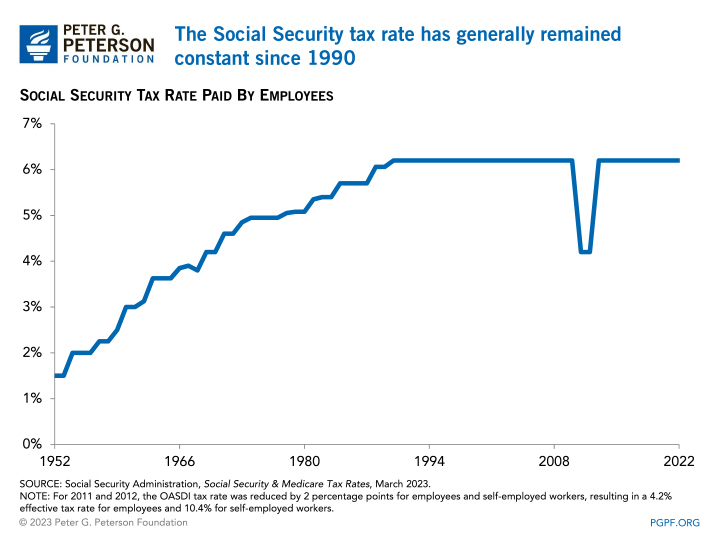

The rate of social security tax on taxable wages is 6.2% each for the employer and employee. 1.45% for the employee plus.

See What You Might Receive.

The federal government sets a limit on how much of your income is subject to the social security tax.

The Internal Revenue Service Has Announced An Increase In The Social Security Wage Base To $168,600, Up From $160,000.

This online social security benefits calculator estimates retirement benefits based on your age, retirement date and earnings.

Social Security Benefits Will Rise 3.2% In 2024.

Images References :

Source: filiaqmarney.pages.dev

Source: filiaqmarney.pages.dev

Employer Social Security Tax Rate 2024 Maggee, Social security's formula bases benefit amounts primarily on two factors: The tax rate for an employee's portion of the social security tax is 6.2%.

Source: philconsult.com

Source: philconsult.com

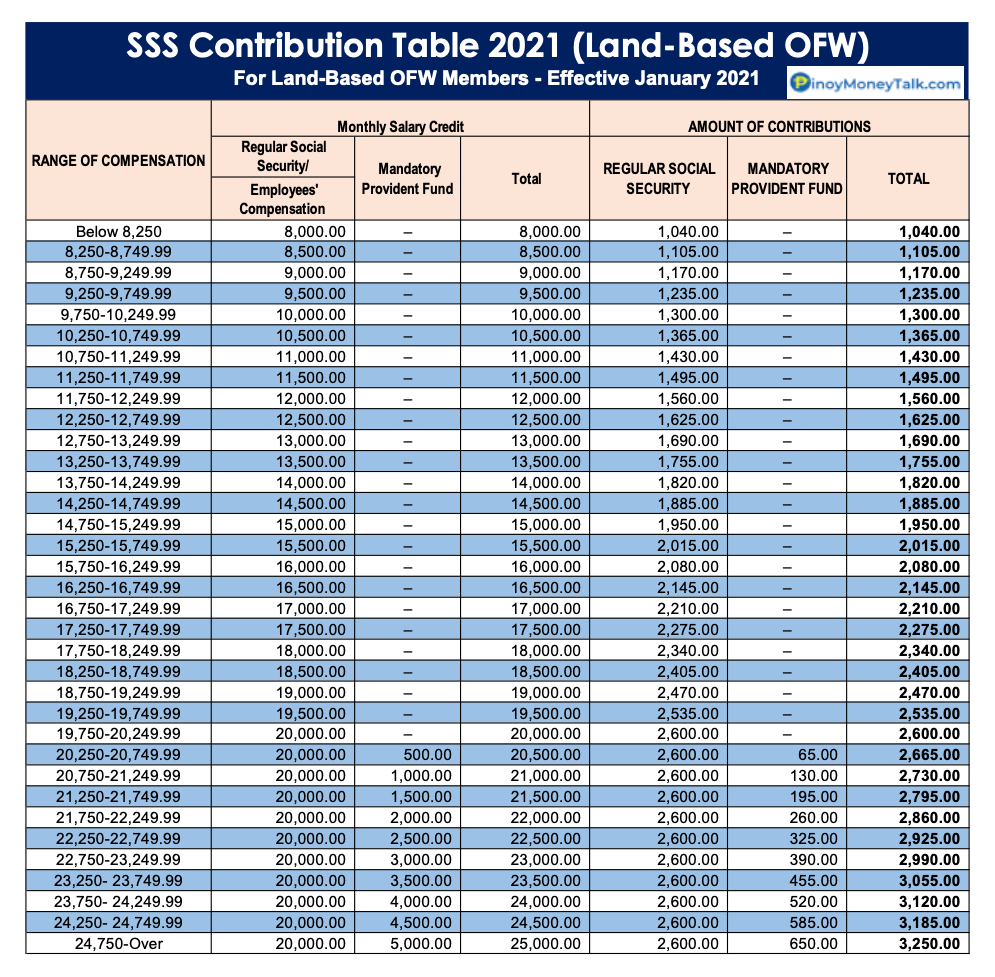

New Schedule of Social Security (SS) Contributions for Employers (ERs, In 2024, workers will pay social security tax on their first $168,600 in wages. Social security payouts jump as 3.2% cola kicks in for 2024.

Source: www.youtube.com

Source: www.youtube.com

How To Calculate, Find Social Security Tax Withholding Social, The maximum benefit depends on the age you retire. Federal payroll tax rates for 2024 are:

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, 6.2% social security tax on the first $168,600 of wages, making the maximum tax $10,453.20 (6.20% times $168,600), plus. Thus, an individual with wages equal to or larger than $168,600.

Source: jtcaccountingservice.wordpress.com

Source: jtcaccountingservice.wordpress.com

SSS Contribution Table for Employees, SelfEmployed, OFW, Voluntary, Social security tax limit for 2024. The most you will have to pay in social security taxes for 2024.

Source: www.howtoquick.net

Source: www.howtoquick.net

SSS Contribution Table 2022 New Schedule Effective January, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. For 2024, an employee will pay:

Source: kegero.com

Source: kegero.com

Payroll Taxes What Are They and What Do They Fund? (2023), The absolute maximum social security benefit in 2024 is $4,873 monthly, more than double the estimated average of $1,907 retirees receive across the nation as. In 2024, workers will pay social security tax on their first $168,600 in wages.

Source: victoriatodd.z19.web.core.windows.net

Source: victoriatodd.z19.web.core.windows.net

Va Disability Rates 2024 Increase Chart, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000.

Source: www.388fw.acc.af.mil

Source: www.388fw.acc.af.mil

What you need to know about the Social Security Tax Withholding, The social security wage base —. October 12, 2023 • by jeffrey buckner, acting deputy commissioner for communications.

Source: vaclaimsinsider.com

Source: vaclaimsinsider.com

Official 2023 Pay Chart for VA Disability (The Insider’s Guide), Social security's formula bases benefit amounts primarily on two factors: [3] there is an additional.

The Social Security Wage Base —.

The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000.

The Federal Government Sets A Limit On How Much Of Your Income Is Subject To The Social Security Tax.

That’s up 5.3% from $160,200.