Tax Free Gift Limit 2024 Over 50

Tax Free Gift Limit 2024 Over 50. 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000. For married couples, the limit is $18,000 each, for a total of $36,000.

Gift tax in india is applied when the value of the received gift exceeds ₹50,000 in the financial year. For 2024, the annual gift tax limit is $18,000.

Tax Free Gift Limit 2024 Over 50 Images References :

Source: trishbvalentine.pages.dev

Source: trishbvalentine.pages.dev

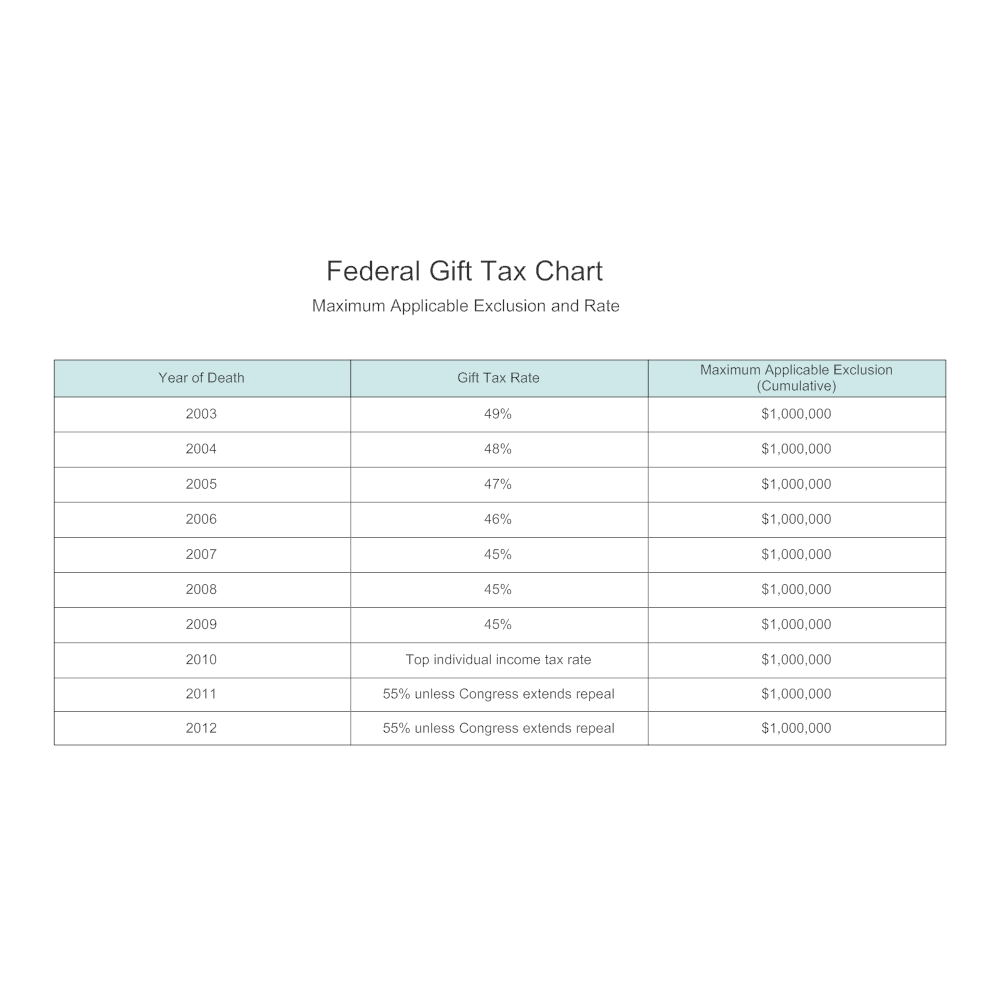

What Is The Gift Tax Limit For 2024 And 2024 Lark Sharla, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: kaciebdoralynne.pages.dev

Source: kaciebdoralynne.pages.dev

Tax Free Gift Limit 2024 Bobby Christa, The gift tax limit (also known as the gift tax exclusion) is $18,000 for 2024.

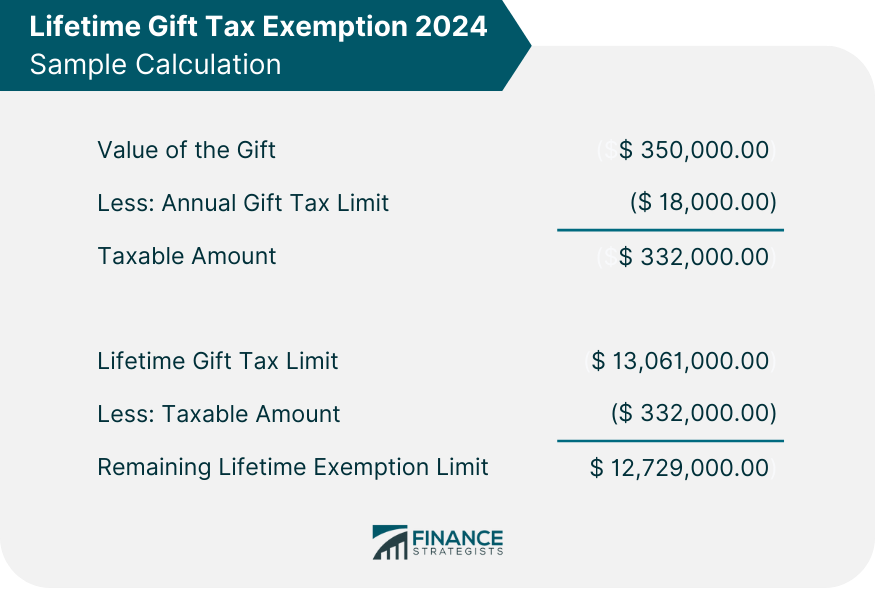

Source: www.financestrategists.com

Source: www.financestrategists.com

Gift Tax Limit 2024 Calculation, Filing, and How to Avoid Gift Tax, The irs has specific rules about the taxation of gifts.

Source: www.datos.org

Source: www.datos.org

IRS Gift Limit for 2024 TaxFree Gifts, Rates, and Spouse/Minors Limits DATOS, Strategies such as trusts can also help mitigate potential gift taxes.

Source: halieqgiuditta.pages.dev

Source: halieqgiuditta.pages.dev

Tax Free Gifts 2024 Libby Othilia, The highest gift tax rate is 40% for taxable gifts.

Source: www.kazilawfirm.com

Source: www.kazilawfirm.com

2024 Gift Tax Exemption Limits Know the Rules, Gifts received in india are taxable if the monetary value of all gifts received without consideration by the recipient exceeds inr 50,000.

Source: lisheymerralee.pages.dev

Source: lisheymerralee.pages.dev

Irs Tax Free Gift Limit 2024 Patty Faustine, Any gift received from a relative as defined under the income tax act is not taxable in the hands of the recipient, irrespective of the amount received, in other words, there.

Source: www.financestrategists.com

Source: www.financestrategists.com

Gift Tax Limit 2024 Calculation, Filing, and How to Avoid Gift Tax, The gift tax limit (also known as the gift tax exclusion) is $18,000 for 2024.

Source: chickybmelesa.pages.dev

Source: chickybmelesa.pages.dev

Tax Free Gift Limit 2024 Ireland Jessi Lucille, As of 2024, the lifetime.

Source: gennaharriott.pages.dev

Source: gennaharriott.pages.dev

Irs Tax Free Gift Limit 2024 Nessy Adelaida, The tax rate depends on your income tax slab.

Posted in 2024